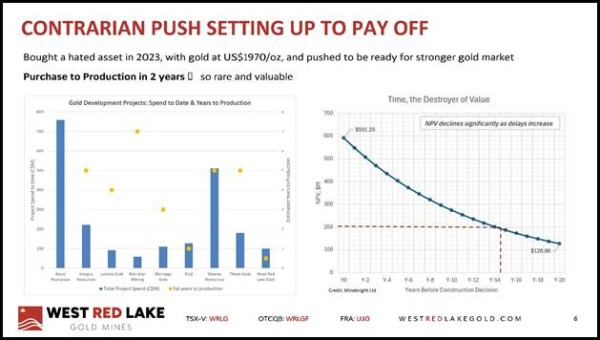

The plan has always been to restart Madsen as a sustainable mine. With anticipated production just months away, we are on track to deliver this project from purchase to production in only two years.

Canada, 14th Apr 2025 – Sponsored content disseminated on behalf of West Red Lake Gold. On April 9, 2025, West Red Lake Gold Mines (TSXV: WRLG) (OTCQB: WRLGF) updated the market on its 22-month accelerated ramp-up to production.

West Red Lake Gold is one of only four single-asset companies putting a new gold mine into production in 2025.

In the last 12 months WRLG has de-watered, drilled, developed, tested, bulk-mined and completed a tailings dam lift, as the price of gold has risen 37% from USD $2,300 to USD $3,150. The spot price of gold is now $4,500 Canadian dollars.

“Gold is currently the ultimate safe haven, together with JPY, EUR, and CHF, as worries about U.S. fiscal stability and rising inflation render U.S. Treasury bonds useless as a haven investment,” stated Ole Hansen, Head of Commodity Strategy at Saxo Bank.

Typically, when there is a flight to gold, the gold juniors (NYSE: GDXJ) outperform bullion and big-cap miners.

“We bought a complicated asset, assessed needs, and got to work,” stated WRLG President and CEO Shane Williams in the April 9, 2025 press release. “Our plan has always been to restart Madsen as a sustainable mine. With anticipated production just months away, we are on track to deliver this project from purchase to production in only two years.”

In this April 11, 2025 video, VP of Communications Gwen Preston gives context to the pre-production updates.

“In addition to the stated goals, we also purchased and commissioned 19 major pieces of underground equipment at a cost of $5.7 million,” stated Preston, “We implemented a new company-wide Enterprise Resource Planning system and we developed a mine site workforce that is now over 200 people.”

“We have said from the start that we intended to restart the Madsen mine in 2025. With all of these accomplishments, we are on track to ramp this operation up through the second half of the year.”

The press release compared the stated operational goals with the achieved results:

Goal initially stated October 2023: Complete 39,000 metres of underground drilling by the end of 2024. Accomplishment: From October 2023 through Q1 2025: Completed 88,191 metres of drilling from underground at Madsen.

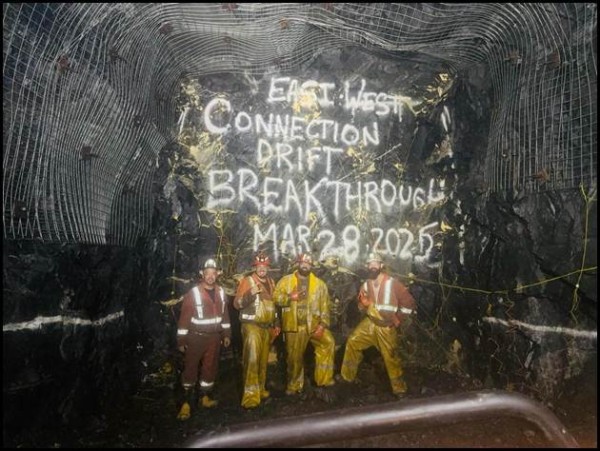

Goal Stated October 2023: Complete 3,200 metres of underground development at Madsen in 2024. Accomplishment: Completed 3,065 metres of underground development at Madsen in 2024. To date in 2025, the Company has completed another 1,178 metres. These metres are in addition to the development of the Connection Drift.

Goal Stated June 2024: Complete a Pre-Feasibility Study (PFS) for the restart of the Madsen Mine by November 2024. Accomplishment: The results of the PFS were published on January 7, 2025.

Goal initially stated June 2024: Initiate a test mining program to assess longhole stope and cut-and-fill mining methods. Accomplishment: Six months of test mining successfully produced the bulk samples.

Goal initially stated June 2024: Use a test mining program to generate a bulk sample to enable a reconciliation test between expected and actual tonnes and grade for planned stopes. Accomplishment: A bulk sample program of 6 stopes totalling at least 15,000 tonnes is almost complete.

Goal Stated October 2023, Refined June 2024: Complete a 1,200-metre haulage way connecting the East and West Portals of the Madsen Mine by March 31, 2025.Accomplishment: The 1,448-metre Connection Drift was completed on March 28, 2025.

Goal Stated June 2024: Complete a 4-metre tailings dam lift to ensure adequate capacity to support tailings management. Accomplishment: A 4-metre tailings dam lift was completed on October 8, 2024.

Goal Stated June 2024: Procure and install a camp to house 100 workers at the Madsen site. Accomplishment: A 114-person camp opened for operation at the Madsen Mine on March 18, 2025, with junior suites, a cafeteria, a gym, and full staffing.

Goal Stated June 2024: Install a permanent primary crusher. Accomplishment: A permanent primary crusher is operating at the Madsen Mine.

Goal Stated June 2024: Procure, install, and staff a mine dry sufficient to support miners of a full-operations Madsen mine team to transition in and out of shifts. Accomplishment: The constructed mine dry received its occupancy permit on April 3, 2025, and is now welcoming workers.

Goal Stated June 2024: Continue dewatering the mine. Accomplishment: Dewatering has almost reached level 17, an achievement of 70 vertical metres since dewatering started in the fall of 2023.

Goal Stated June 2024: Install two evaporator fans with the ability to manage 2,000 cubic metres of water daily. Accomplishment: Two evaporator fans were installed and commissioned in the summer of 2024.

Goal Stated October 2023: Publish updated Mineral Resource Estimate for Rowan by Q4 2023. Accomplishment: An updated MRE for Rowan was published in March 2024.

Goal Stated October 2023: Restart the Madsen Mine in 2025. Accomplishment: The Madsen Mine is on track to start operating by H2 2025.

“We delivered every named project on or close to schedule,” reported Williams, “while completing a host of other requirements from staffing the mine to securing funding. Collectively, these efforts have Madsen on track to start operating in H2 2025.”

“When investors rotate into gold, they look for large producers, growing producers, and new producers,” Preston told Global Stocks News (GSN). “We are a strong candidate in the third category, operating in a Tier 1 Mining jurisdiction.”

According to a conservative Pre-Feasibility Study released in January 2025, West Red Lake Gold’s Madsen Mine will generate CAD $93 million/year in free cash flow, calculated based on USD $2,600/ounce long term gold price ($600/ounce lower than the current price).

The price used to determine economic reserve tonnes in the PFS was US$1,680 per ounce. A graph on page 15 of the 395-page WRLG technical report projects that lifting that price to US$2,400 boosts the resource tonnes considered for reserve inclusion by almost 77% (3,072 to 5,438 tonnes).

Sustained higher gold prices have the potential to significantly boost free cash flow and resource tonnes.

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for technical disclosure at the West Red Lake Project, as defined by NI 43-101 “Standards of Disclosure for Mineral Projects”.

Contact: guy.bennett@globalstocksnews.com

Disclaimer: West Red Lake Gold paid Global Stocks News (GSN) $1,750 for the research, writing and dissemination of this content.

Full Disclaimer: GSN researches and fact-checks diligently, but we cannot ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN publications may contain forward-looking statements such as “project,” “anticipate,” “expect,” which are based on reasonable expectations, but these statements are imperfect predictors of future events. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Times World USA journalist was involved in the writing and production of this article.