Scientific innovations are the driving force for times transformation. Following steam engines, electricity and computer, Blockchain has brought a new revolution to technology and industry of this era.

When it comes to the currently most-talked-about blockchain technology, the decentralized finance (DEFI) deserves a special mention.

As of June 2020, the daily value locked in DEFI has broken the record, now standing at 27.3 billion dollars. It has been nibbling away at the trillion-dollar digital currency market, growing continuously into a giant.

DEFI presents huge market dividends, attracting many industry pioneers to grasp the preemptive opportunities for participation.

OPEN – Bring a wider range of assets to DeFi

OPEN is right among them. OPEN Foundation has started the overall layout of DEFI industry since 2019. After prudent and comprehensive considerations, OPEN chose OnlyChain.

Based on its analysis of OC’s position ratio via its digital asset management company with BTC Grayscale as a benchmark, OPEN has long appreciated OC and set mind to build DEFI ecology on OC system.

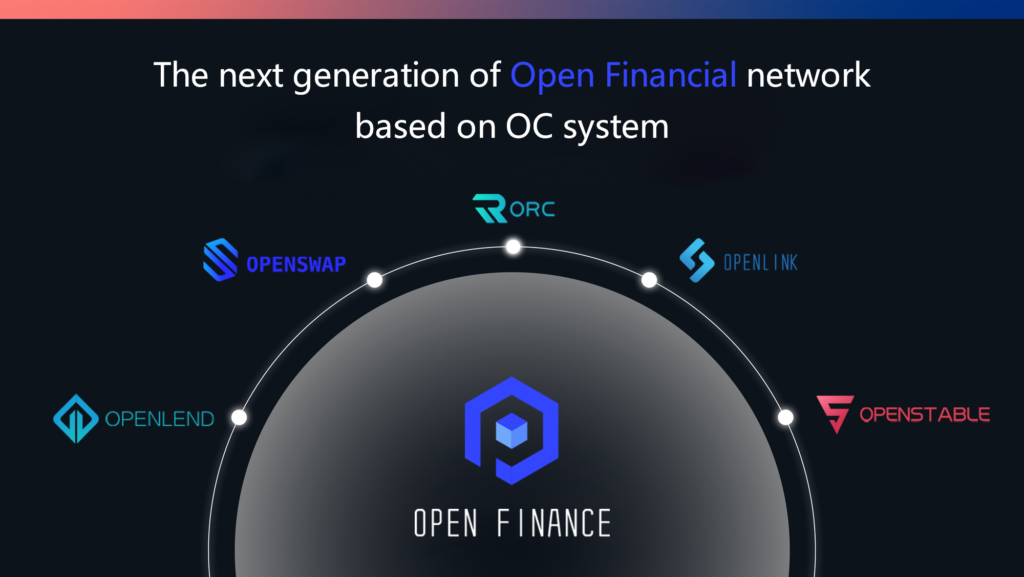

Open Finance is a basket of open finance and currency protocol applications developed by OPEN Foundation on OC. Through the protocol matrix with strong composability, it aims to realize a huge financial machine that can run and evolve by itself to replace the current economic operating mode and become a decentralized full-domain world bank.

OPEN is the first team to propose and practice protocol matrix concept in the industry. Its mature and supporting DEFI infrastructure provides one-stop decentralized financial solutions for global users and a unified liquidity space to serve open finance of the future.

Open Swap – Decentralized Exchange

Asset trading and clearing are important parts of traditional economic activities. It is Open Swap that assumes the above responsibilities in the OPEN system.

Open Swap delivers one-stop on-chain trading services for users based on its three core technologies and 20000+ TPS. The transfer speed speaks for itself. Also, the underlying operating system of OC does make Open Swap extremely competitive in processing large and low-frequency transactions, providing users with smooth on-chain trading experiences.

Open Lend – Hybrid Lending Market

Open Lend benchmarked against the lending and financial derivative issuance in the traditional economic activities can automatically calculate interest rates based on supply-demand change.

This benefits borrowers and lenders, making up for the opportunity cost of holding assets in an open financial network and getting rid of the fixed interests from the traditional financial market.

Open Stable – Asset Protocol Aggregation Platform

Open Stable is the center part of OPEN, allowing users to generate the stable assets OUSD (i.e. stablecoin asset protocol) from the secured assets.

OUSD is encrypted assets softly pegged to US dollars as asset collateral. It provides excess backed assets for users so as to effectively withstand vicious inflation.

And thanks to the technical advantages of OC, Open Stable enjoys high-speed asset transfer and delivery.

Open Link Oracle

OpenLink is the first distributed oracle on OC.

It is a vehicle that captures the value of Open Finance and OnlyChain ecosystem. It has defined and realized a new on-chain price generation and digital value capture plan to fix interoperability issues for the smart contract, which significantly enables it to be applied in finance, insurance, supply chain and many other industries.

Since all full eco-applications in OPEN financial system are built on OC, the above applications are exclusively confined to it. However, there exists a shortage in asset diversity on OC. So, how to achieve OC’s interoperability with other blockchains to expand the Open financial ecosystem?

ORC – An ultimate solution to blockchain interoperability.

Open Reactor

Open Reactor – Cross-chain protocol

Open Reactor (ORC) is the first decentralized cross-chain solution on OC system and also the exclusive cross-chain protocol in OPEN system. It serves as a window for financial data and value exchange with external blockchains.

The core mechanism of ORC cross-chain solution is OrcVM, through which users can use BTC and ETH to generate OBTC and OETH on OnlyChain at 1:1 if asset security is guaranteed. Owing to the high-performance blockchain network of OC, users enjoy extremely low handling fees and high transaction speed.

ORC also allows users to transfer digital assets from OC system to other blockchain networks so that on-chain assets can be freely flowed, interacted and aggregated between different blockchains, thus bringing the entire cryptocurrency market back to its root.

The ORC cross-chain solution can be applied to any sub-application in OPEN system. That’s to say, in the years to come, ORC will be the exclusive channel for OPEN sub-protocol to expand its use scope and interact with other public chains. Its importance is beyond any doubt!

The financial sector is a pioneer in exploring the application of blockchain technology, with different institutions having varied blockchain-based layouts and applications. But there also exist some urgent problems of fragmentation.

ORC can realize asset, information and trade interconnectivity and collaboration between different blockchains, which provides broader imagination space for Blockchain’s further application in the financial sector.

ORC Value Analysis

- Provide OPEN with a variety of practical cross-chain assets to make sub-protocol matrix connected.

OBTC and other cross-chain assets acting as a cohesive layer will run throughout the entire open financial ecology to make closer interactions between various sub-protocols, thus achieving a huge and autonomous DEFI ecosystem.

- Integrate value of BTC and other mainstream digital assets into OC system for OC value expansion.

Relying on the digital token of Open Reactor, ORC will bring the value of Bitcoin and Ethereum into OC network so that asset liquidity of more public chains can be locked into it.

- Offer an interactive channel between various OPEN applications and other public chains to expand the ecological layout.

ORC allows users to generate OBTC with BTC. These cross-chain assets can be uses as trade varieties, lending products and synthetic asset reserve resources between Open Swap, Open Lend and OpenStable, which immensely diversify assets in OPEN and promote their operation and deployment on the whole ecosystem.

- Address problems existing in information interaction, asset transfer and business collaboration between the independent public chains and consortium chains of different industries, like banking, securities, insurance and real estate.

The financial sector is a pioneer in exploring the application of blockchain technology, with different institutions having varied blockchain-based layouts and applications. But there also exist some urgent problems of fragmentation.

ORC can realize the asset, information and trade interconnectivity and collaboration between different blockchains, which provides broader imagination space for Blockchain’s further application in the financial sector.

- Push ahead with the rapid establishment of global financial integration or regional economic integration.

Cross-chain enables value to flow between different blockchains. During this process, users, data and scenarios can be well linked to finally build a larger value ecosystem. If cross-chain technology grows into maturity, blockchain in the future will become infrastructures like today’s highways, water and electricity supplies. This will greatly facilitate the free flow of value and promote global financial integration.

Conclusion

If OPEN is a new self-evolving and self-sustaining decentralized financial empire, ORC cross-chain solution will be its “reform and opening-up policy.” Only by embracing a bigger external world can we accelerate the rapid and stable development of ecology and build a “sun-never-set empire.”

About us

https://www.openfin.network/#/

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Times World USA journalist was involved in the writing and production of this article.